What do you do when Spotify hands you $100 million?

If you're Joe Rogan, you buy a $14.4 million lakefront house in Austin and turn it into your podcast headquarters.

Talk about the ultimate work-from-home setup.

Joe Rogan's Austin House: Quick Facts

Joe Rogan's house in Austin sits on 4 acres of land with 300 feet of Lake Austin waterfront.

The 10,980-square-foot house was originally built in 2008 as a Tuscan-style villa.

It was redesigned by architect Benjamin Wood and his wife Theresa into a modern farmhouse.

- Location: Lake Austin, Texas

- Purchase Price: $14.4M (2020)

- Current Value: ~$17M (2025)

- Bedrooms: 8

- Bathrooms: 10

- Land: 4 acres

- Waterfront: 300 feet of Lake Austin shoreline

- Interior Design: FAB Architecture/Benjamin Wood Design

- Landscape: FAB Architecture

- Structural: Smith Engineering

- Amenities:

- Custom-built podcast studio

- Gym

- Cold plunge tub

- Sauna

- Swimming pool,

- Three docks,

- Wine cellar with tasting area,

- Inground trampoline,

- Carriage house for RV/boat storage,

- Two garages and more.

- Photography: Peter Vitale

Why Did Joe Rogan Move to Austin, Texas?

Joe Rogan ditched California for Austin, TX in 2020. It's no mystery why The Wall Street Journal called Austin "the low cost, high reward darling of big tech".

Key reasons for his move in 2020 include:

- Freedom & Space: Rogan wanted land for outdoor hobbies (hunting, hiking, martial arts), something the city-life could never offer.

- No State Income Tax: Texas has

0% state income tax, allowing high earners like Rogan (who signed a

$100M+ deal with

Spotify) to keep more of their income.

- Tech & Culture Hub: Austin is often dubbed a

“tech darling” for its

booming tech scene and

vibrant arts/music culture (SXSW, live music capital).

Rogan joined a wave of entertainers and tech CEOs moving to Austin like Elon Musk, Sandra Bullock, Matthew McConaughey.

If you’re also looking for a house in Austin, remember

no dream is too big:

contact us to get

pre-approval or see

mortgage options tailored to your situation.

Inside Joe Rogan’s Austin House: Room-by-Room Exploration

Here's an exclusive look inside every room of Joe Rogan's $14.4 million Austin house.

The Grand Entrance: Rustic Meets Modern

The front doors open into a high-ceiling entryway with smooth concrete floors and wood-paneled walls.

A

metal chandelier hangs above, adding that

ranch-style touch.

In Joe Rogan's entry hall you’ll find:

- Double front doors with premium hardware

- Wide-plank wood wall

paneling for warmth

- Statement wrought-iron chandelier as focal point

- Massive glass walls showcasing backyard views

Living & Dining Areas: The Heart of Rogan's House

Panoramic Windows & Views

The entire back wall of Joe Rogan's Living Area is floor-to-ceiling glass with views of Lake Austin and the Hill Country.

Interior Design Details

- One dramatic deep blue accent wall contrasting with pale wood pillars

- Exposed wood beams running across vaulted ceilings

- Built-in floor-to-ceiling library wall

showcasing Rogan's extensive book collection

- Reclaimed wood dining table custom-built to seat

10+ guests

Indoor-Outdoor Integration

Glass doors slide open completely, connecting the dining room directly to outdoor terraces.

This creates one large space for everything from family dinners to big parties.

Art Pieces & Personal Touches

Master Suite: Lakeside Luxury Retreat

Master Bedroom

Joe Rogan's master bedroom faces the lake with floor-to-ceiling windows and a private balcony overlooking the water.

The California king bed is positioned for the best views.

Bedroom Features:

- Vaulted ceilings

with exposed beams

- Individual climate control

separate from the rest of the house

- Private balcony with outdoor seating and lake views

- Hidden flat-screen TV that rises from a custom cabinet at the foot of the bed

Spa-Like Master Bathroom

The en-suite bathroom in Joe Rogan's house rivals luxury resort spas:

- Massive walk-in rain shower with multiple shower heads, and a soaking tub

- Natural stone surround creating a zen-like atmosphere

- Separate controls for water temperature, jets, and aromatherapy

Vanity Areas:

- His-and-hers double vanities with backlit mirrors

- Heated floors for comfort

- Small window overlooking a private zen garden

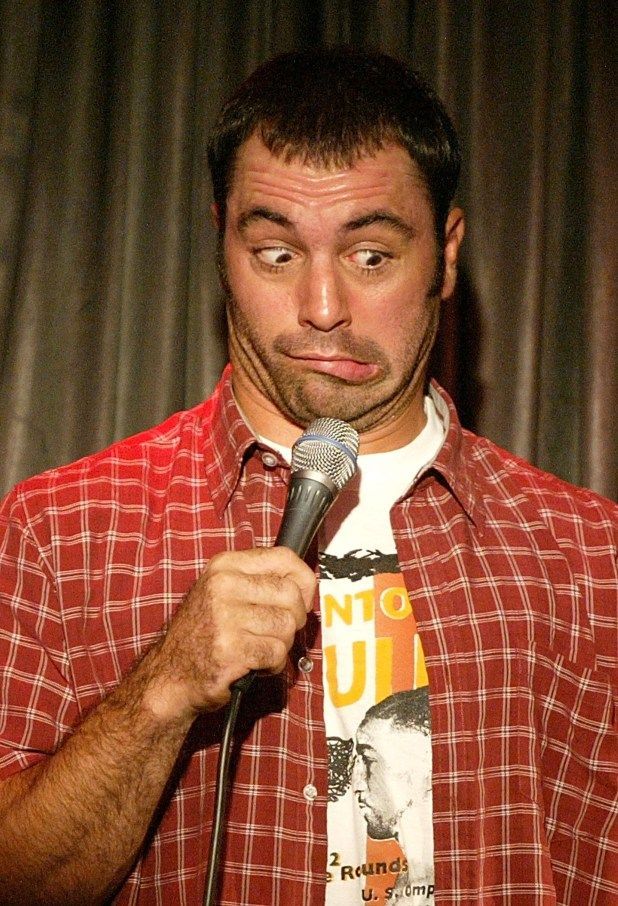

Joe Rogan's Podcast Studio: Where The JRE Journey Began

Joe Rogan built a custom podcast studio with its own soundproof building (big shipping-container-style interior) a short golf-cart ride from his house in Austin.

This keeps studio noise away from family life while allowing 24/7 recording flexibility.

Key studio features include:

Studio Architecture

Originally decked out in red lighting and space-age vibe (with hanging Turkish lamps and alien statues), he later switched to a more industrial look.

Professional Gear

Inside, it’s decked with top-of-the-line gear:

multiple 4K cameras, state-of-the-art microphones (Shure or similar),

mixers, and

monitors.

There’s a

main table for Rogan and his guests (often with skulls or armor as props!).

Tip: If you’re inspired to build a home studio or gym like this, check out our financing options! Austin buyers often use cash-out refis to fund home offices and upgrades.

The Gourmet Kitchen: Built for a Food Enthusiast

Joe Rogan's house features a show-stopping kitchen with

double islands, top-tier appliances, and

eclectic decor.

Key features include:

Rogan has

two massive kitchen islands in his kitchen, each for a different purpose:

- Prep Island: Butcher-block surface for wild game processing with built-in storage

- Service Island: Marble surface for dining and entertaining with bar seating for 6+

- Dual Sub-Zero refrigerators (perfect for storing elk and venison)

- Commercial-range stove with 8 burners and dual ovens

- Wine refrigerator and professional ice maker

Custom Design Elements

- Mix of sleek modern cabinets and handpicked antique cabinet fronts

- Polished marble countertops with custom tile backsplash

- Breakfast nook with three-sided lake views

- Direct access to outdoor BBQ kitchen with built-in grills and smoker

If you want a kitchen like Joe Rogan, you might want to look for a house in Texas.

You often get more house (and gourmet kitchen) for your money in Texas versus California.

Get a free mortgage quote to see what your budget can do in the Texas market.

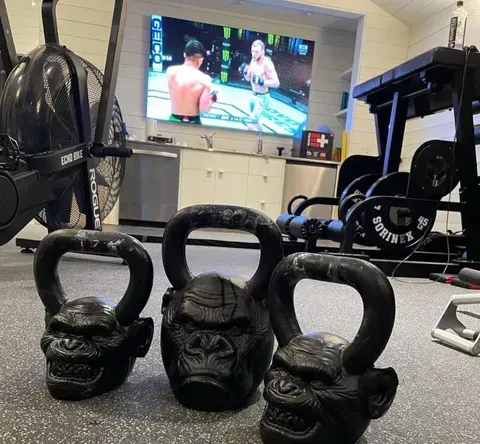

Home Gym: Professional Training Facility

Rogan's fitness obsession shows in every detail:

Weight Training:

- Rogue power racks and Olympic platforms

- Complete barbell and dumbbell sets

- Professional bench press setup

Martial Arts Area:

- Large padded mat for Brazilian Jiu-Jitsu

- Heavy bags for striking practice

- Grappling dummies and suspension trainers

Recovery Zone:

- Cold plunge tub (Rogan's famous for ice bath advocacy)

- Sauna for heat therapy

Home Bar:

Joe Rogan's house would be incomplete without a home bar.

Key features include:

- Carved-wood bar with craft beer taps

- Top-shelf liquor display

- Pool table and multiple TVs for UFC nights

- Deep blue walls creating cozy pub vibes

Additional Spaces

- Media room with projection screen

- Wine cellar with climate control

- Multiple guest suites for visiting podcast guests

Outdoor Paradise: Lake, Pool, Decks & More

Looking out from the infinity pool towards Lake Austin, Joe Rogan's house is an ultimate outdoor recreation setup.

Pool & Lake

The infinity pool merges visually with the lake.

Docks

Three docks mean plenty of space for boats or jet skis.

One dock has a

covered party deck with

shade umbrella.

Sports

A half-basketball court and open turf let the family play ball on weekends. Rogan’s hobby shows! There are targets and space for archery practice.

Campfire

A

stone fire pit under the

oaks is perfect for late-night fireside chats.

In short, in Joe Rogan's house, everything’s at your fingertips from fitness to fun, indoors and out.

Joe Rogan's Net Worth & How He Funds His Lifestyle?

Joe Rogan’s $14.4 million house in Austin is just one piece of his fortune.

With an estimated net worth of $120–150 million, his wealth comes from several major sources:

Podcasting

The Joe Rogan Experience was licensed to Spotify in 2020 under a deal reported to be worth $200 million.

Even beyond exclusivity, the show generates massive ad revenue.

Stand-up Comedy & Tours

Joe Rogan has been touring for decades, selling out arenas worldwide.

His comedy specials on Netflix and live ticket sales remain a steady income stream.

UFC Commentator

Since 1997, he has served as a UFC color commentator, earning both salary and recognition in the MMA community.

Television Career

Hosting Fear Factor in the early 2000s brought him mainstream fame and millions in paychecks.

Investments & Endorsements

Joe Rogan has invested in supplements (Onnit), fitness ventures, and media-related companies.

These income streams explain how Rogan comfortably maintains multiple properties and a lifestyle centered on fitness, hunting, and private time with family in Austin.

Does Joe Rogan Own a Yacht?

Although Rogan’s Austin estate gives him direct lake access for smaller boats and watercraft, he has also been photographed on $50M yachts during vacations.

These sightings underline his taste for privacy, comfort, and time on the water; themes that fit with his overall lifestyle.

Rogan isn’t part of the Hollywood “superyacht” crowd known for collecting hundred-million-dollar vessels.

Instead, his approach is more practical: Lake Austin docks for daily use, and charters or borrowed yachts for trips abroad.

It mirrors his broader philosophy; wealth as freedom, not just display.

How Many Houses Has Joe Rogan Owned?

Rogan has bought and sold several homes over the years, reflecting both his career growth and desire for privacy:

- California: He owned multiple homes in

Bell Canyon, California, including a

7,500 sq ft property with a gym and recording space.

One sold in 2020 for around $3 million. - Austin, Texas: His current $14.4 million lakeside mansion purchased in 2020, with nearly 11,000 sq ft, a gym, podcast studio, and private boat docks.

- Colorado (unconfirmed): Rogan has mentioned spending time in Colorado, though no verified public record confirms a current property.

Joe Rogan’s Family Life

Though often in the spotlight, Rogan keeps his personal life relatively private.

Who is Joe Rogan's wife?

Rogan married Jessica Ditzel, a former model and cocktail waitress, in 2009.

How many children does Joe Rogan have?

The couple has two daughters together, and Rogan is also stepfather to Jessica’s daughter from a prior relationship.

Why did Joe Rogan move to Austin?

Rogan has spoken about wanting to raise his kids away from Hollywood, one of the reasons the family relocated to Austin, Texas.

His move to Austin in 2020 wasn’t just financial, it was also about lifestyle.

The family wanted more space, privacy, and a community better aligned with their pace of life.

Joe Rogan's Growing Influence: From Austin Podcaster to Presidential Inauguration Guest

Recent News (January 2025):

Joe Rogan attended President Donald Trump's inauguration at the U.S. Capitol on January 20, 2025, marking another milestone in his journey from comedian to one of America's most influential media figures.

Political Influence Without Leaving Austin

What's remarkable is that Rogan wields this influence entirely from his Austin compound.

Unlike traditional media figures who relocate to Washington D.C. or New York, Rogan built his empire from Texas:

- 200+ million podcast downloads monthly

- Endorsed Trump before the 2024 election after hosting him on the podcast

- Maintains editorial independence, recently criticized Trump's deportation policies as "horrific" despite attending the inauguration

- No formal advisory role, continues running his show from his Lake Austin studio

This represents a new model of media influence: building authority through authentic conversation rather than proximity to power centers.

How Do Home Buyers Finance Homes Like This?

Most buyers don’t wire

$14M in cash. Even celebrities leverage

jumbo loans and portfolio lending strategies to optimize cash flow and tax advantages.

Curious what financing a $1M+ property would look like for you?

Understanding the $14.4M Price: Why Land Trumps Square Footage in Austin?

At first glance, $14.4 million for an 11,000 sq ft home might seem steep, even in Austin's hot market.

Here's what makes lakefront properties command premium pricing:

What You're Really Buying

The Land, Not Just the House. In luxury waterfront real estate, you're primarily purchasing:

- 300 feet of private Lake Austin shoreline (extremely rare and finite resource)

- 4 acres of prime Texas Hill Country (can't be replicated)

- Deep-water access with boat dock rights (limited availability)

- Unobstructed views protected by zoning and conservation

The Numbers Behind Luxury Lakefront

Lake Austin has only 19 miles of total shoreline, with much of it already developed or conservation-protected.

When properties become available, especially with 300+ feet of frontage, prices reflect decades of scarcity.

Comparable Properties:

- Average Lake Austin waterfront: $3,000-$5,000 per linear foot

- Premium locations: $5,000-$10,000+ per linear foot

- Rogan's 300 feet at $14.4M = ~$48,000 per linear foot (reflects the complete package: land + improvements + location)

In markets like Lake Austin, the house is almost secondary, you're investing in irreplaceable geography.

From Celebrity Moves to Your Mortgage Strategy

You don’t need a $14M mansion to take advantage of the same mortgage strategies.

At Austin Capital Mortgage, we specialize in helping:

- Self-employed borrowers (1099, freelancers, entrepreneurs)

- High earners relocating to Texas

- Investors looking for luxury appreciation

Luxury homes in Austin are holding value even as national housing markets cool.

Inventory is tight, demand is strong, and high-income buyers are still relocating here in 2025.

For borrowers, that means two things:

- Financing flexibility is everything. Standard loans don’t cut it for high-value homes.

- Speed matters. The best properties in Lake Austin, Barton Creek, and Westlake still move fast.

Ready to Make Austin Your Home?

If you’re feeling inspired by Rogan’s big move and want your own Texas house, we’re here to help you do just that.

At the end of the day, you don’t need a $100M Spotify deal to afford a piece of Austin.

With the right mortgage partner and loan product, many self-employed borrowers are finding they can buy their own home in Austin, whether it’s a lakeside home, a downtown condo, or a hill country ranch.

How Can You Finance an Austin Dream Home?

Here are some pointers on financing a luxury or unique property in Austin:

- Loan Types: For multi-million-dollar purchases like Rogan’s, jumbo loans are standard. (Our team specializes in Jumbo mortgages for high-end homes.)

If you’re

self-employed or have complex income,

bank-statement loans or

asset-based programs can qualify you based on

cash flow

or

net worth instead of

traditional W2s.

- Renovation Loans: Want to customize or build? Austin has

renovation loan programs (like the FHA 203k or portfolio renovation loans) that let you

borrow extra for

home improvements.

Use these to upgrade kitchens, add a home studio, gym, or even remodel an older property. - Refinancing Options: If you

already own and want to move or renovate,

cash-out refinance is an option.

It lets you tap home equity at today’s higher property values.

Many of our clients take out equity to fund moves or remodels. - Qualifying Documents: Self-employed buyers should prepare

12–24 months

of

bank statements, profit & loss statements (CPA-prepared P&L), and any

1099s.

Asset-based loans often require proof of assets (retirement accounts, stocks).

We can work with accountants to gather what lenders need. - Interest Rates: Rates can vary (typically around

6–7% for

jumbo as of 2025) and will depend on

credit

and

down payment.

We offer adjustable-rate and fixed-rate options.

With our network of lenders, we find the best terms for your profile. - Timeline: Luxury home

closings (with clean docs) often happen in

~30–45 days.

Thinking of moving to Austin? Don’t let financing be the obstacle.

Call us, and let’s make your Austin dream home a reality.

From bank statement loans to conventional mortgages, we have mortgage options to suit every scenario.

Just as Joe Rogan found his freedom and oasis here, you could be one smart move away from yours.

Complete this quick 2-minute form to see how much home you qualify for.

FAQs

Where does Joe Rogan live?

Joe Rogan lives in Austin, Texas.

He moved from California to Texas in 2020 and has since made Austin his primary residence.

Why did Joe Rogan move to Austin, Texas?

Joe Rogan has cited several reasons for moving to Austin, including:

- Lower cost of living compared to California

- No state income tax

- More personal and business freedom

- A growing creative and tech community

Austin also offers large properties with privacy, which aligns with his lifestyle.

Does Joe Rogan own a mansion in Austin?

Joe Rogan owns a high-value residential property in the Austin area that is commonly described as a luxury home or mansion.

While exact details vary by source, reports consistently describe the property as a large, private estate rather than a typical suburban home.

How much did Joe Rogan’s Austin home cost?

Multiple reports estimate Joe Rogan’s Austin home purchase at approximately $14 million.

Exact figures have not been publicly confirmed, but the home is widely considered one of the more expensive residential purchases in the area at the time.

Is Joe Rogan’s home considered a luxury or jumbo property?

Yes.

Based on the estimated purchase price, Joe Rogan’s home would fall into the jumbo loan or luxury property category, meaning it exceeds standard conforming loan limits used by conventional mortgages.

Did Joe Rogan pay cash for his Austin home?

There is no public confirmation that Joe Rogan paid entirely in cash.

Like many high-net-worth buyers, it’s possible the purchase involved financing, but the specific structure of the transaction has not been disclosed publicly.

What type of mortgage would someone need to buy a home like Joe Rogan’s?

Homes in Joe Rogan’s price range typically require:

- Jumbo loans (loan amounts above conforming limits)

- Strong credit profiles

- Significant assets and reserves

- Custom loan structuring

These loans are evaluated on a case-by-case basis and often involve lender-specific guidelines.

Why is Austin popular with high-profile buyers?

Austin has become increasingly popular among celebrities, entrepreneurs, and executives due to:

- No state income tax

- Growing tech and media presence

- Availability of large, private properties

- Lower relative costs compared to coastal cities

Joe Rogan’s move helped accelerate national attention on Austin’s luxury housing market.

Did Joe Rogan’s move impact Austin home prices?

Joe Rogan’s relocation coincided with a broader influx of high-income residents into Austin.

While one individual does not drive a market alone, this trend contributed to:

- Increased demand for luxury homes

- Rising home prices

- Greater interest in jumbo and high-balance mortgages