TEXAS' TOP MORTGAGE LENDERS SINCE '96

Home Loans for Self Employed & 1099 Borrowers

No W2s | No Tax Returns | Flexible Requirements

We shop 100+ lenders to find you the best mortgage options.

Our loan officers and underwriters guide you from approval to closing, typically in 7–21 days.

- Takes 1 min. to complete

Why Choose Us?

A Smarter Way to Buy a Home, Built Around Your Real Options

Our mortgage process is designed to help you see the best loan options you actually qualify for before you commit to a full application.

Individual File Review

Each loan file is reviewed on a case-by-case basis before lender options are presented.

One Day Pre-Approval

Get Pre-Approved in 24 hours. Available for complete files.

Access to Multiple Lenders

We shop 100+ lenders to identify the best loan options for your scenario.

100% Online Application, 5 Star Client Experience

Our average client rating is 5 stars, thanks to our streamlined online process and fast closings.

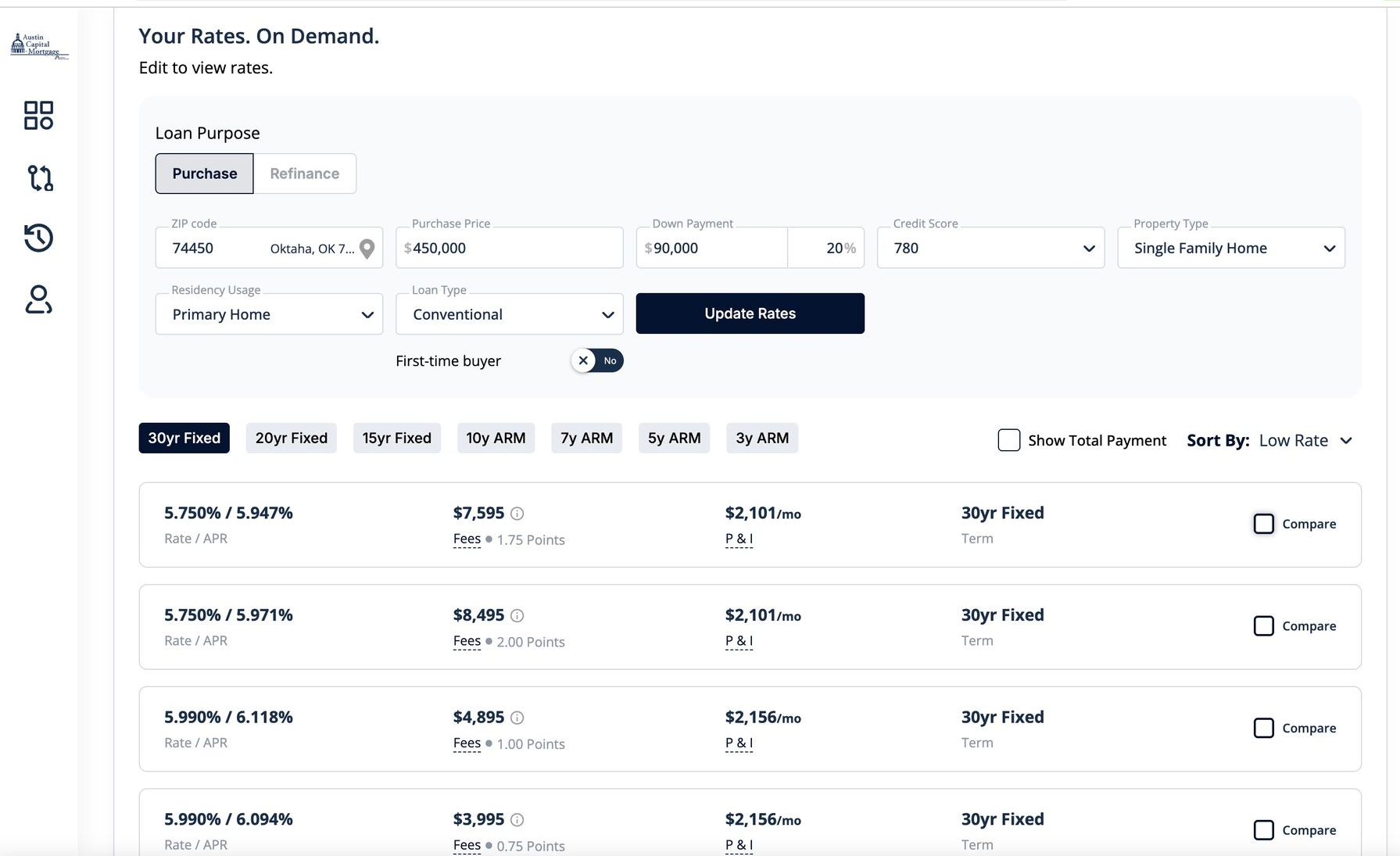

What Rate Can You Actually Get?

Recently Funded Homes

From denied applications to signed contracts, here’s what we’ve funded lately.

What are the eligibility requirements for self employed loans in 2025?

You’ll still need to meet the minimum mortgage requirements that apply to all borrowers, but lenders will scrutinize your finances more closely.

Guidelines vary from lender to lender, but the factors often used to determine the financial health and viability of your business include:

→ How the business operates

Lenders want to ensure that your business is financially sound.

An underwriter may research the location and type of business you’re in, how much demand there is for your product and how likely your business is to stay financially strong and profitable.

→ Personal income vs. business income

If you’re using income from your business to qualify for a loan, your lender may want to see evidence that your business has a healthy cash flow and isn’t buried in debt.

Personal income is typically verified with individual tax returns.

→ Your income stability

A lender may consider you to be at higher risk of missing mortgage payments if your earnings tend to vary from month to month.

That’s why some lenders ask for additional proof that your business is stable and that you have enough cash flow to handle a lower-earning month.

→ How long you’ve been self-employed

A lender prefers for you to have at least two years of experience earning income from self-employment.

The approval process may be simpler, however, if you’ve been in business for at least five years.

Frequently Asked Questions

Or give us a call at: