TEXAS' TOP MORTGAGE LENDERS SINCE 1996

Cash Out Refinance: Turn Your Home Equity Into Cash at Today's Rates

See how much of your home equity you can access (up to 80%) and get cash within 30 days.

- Quick cash-out estimate

- Monthly payment breakdown

- Side-by-side lender comparison

See your cash-out options in 60 seconds. No obligation.

Why Choose Austin Capital Mortgage?

- No Mortgage Insurance on conventional and jumbo loans below 80% LTV, keeping more money in your pocket every month.

- Higher Loan Limits for competitive real estate market.

- Flexible Qualification with

multiple lender options for various credit profiles.

- 20+ Years of Expertise & streamlined process to ensure timely closing.

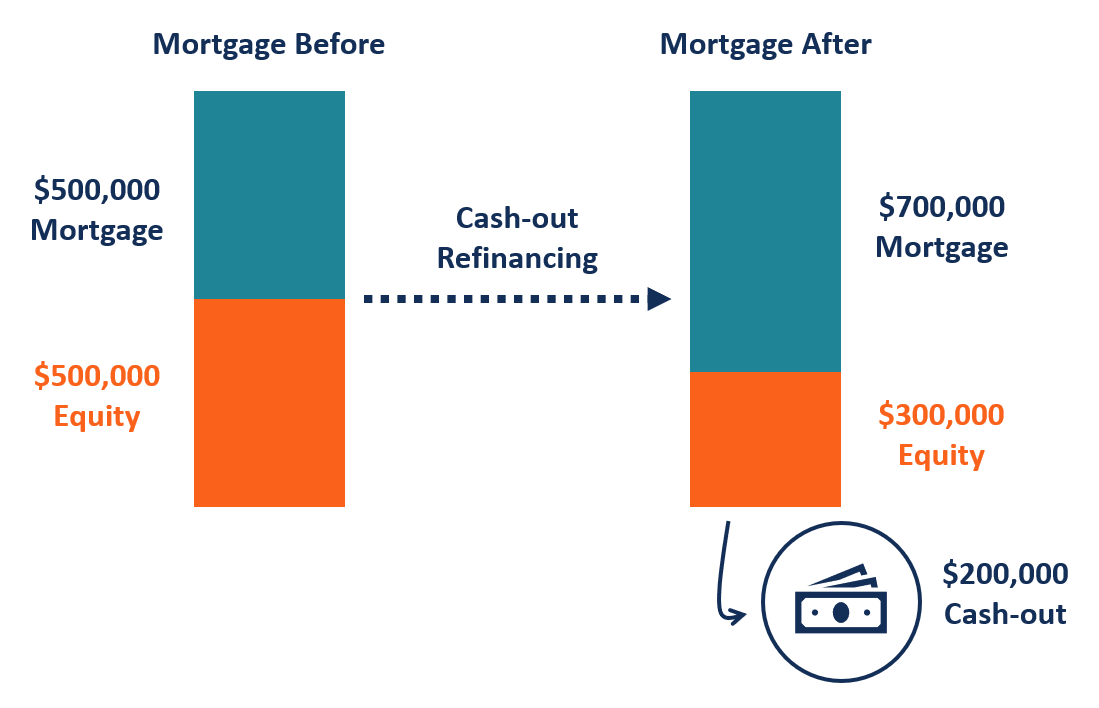

Cash-Out Refinance: What It Is and How It Works?

A cash-out refinance replaces your current mortgage with a new one and lets you take out part of your home equity as cash.

Example:

- Home value: $700,000

- Current balance: $500,000

- Cash available: Up to $200,000, minus closing costs

The new loan has its own rate, term, and monthly payment. You can take only what you need.

Our Cash-Out Refinance Programs

We offer multiple cash-out refinance options to match your unique financial situation.

Each program has distinct advantages depending on your credit profile, home value, and equity position.

Conventional Cash-Out Refinance

Best For: Homeowners with strong credit and at least 20% equity

FHA Cash-Out Refinance

Best For: Homeowners with less-than-perfect credit or limited equity

Jumbo Cash-Out Refinance

Best For: High-value properties in Austin, Dallas, and other competitive markets

Frank G.

ACM was able to close on a new purchase and an existing property cash out refi within 1 month. It was a tall order during a busy real estate market. All staff provided excellent support and advise throughout the process. Highly recommend them for your real estate transaction needs!

Jeri Day

I have worked with Austin Capital Mortgage through 4 different sale/refi transactions and they are always amazing! They help find the best deals, always meet the timelines needed and are super pleasant to work with. This latest transaction would have left money on the table if Adrienne had not thought of the best way to utilize some of the concessions available from our seller. We ended up with an even lower monthly mortgage rate due to her quick thinking and hard work! Highly recommend - this team is great!

Cheryl Trbula

I used Austin Capital Mortgage to purchase my home. The process was easy and went very smoothly. My experience was so great that I came back to ACM a year later to do a refinance. The interest rates were so low, they helped me take advantage of the low rates! My refinance was super easy and fast. Everything was well organized and ready to go when it was time to sign. I highly recommend Austin Capital Mortgage. I will certainly be using them again in the future.

Cash Out Refinance: General Eligibility Requirements 2025

Lenders review your income, credit history, home value, and remaining mortgage balance to determine how much equity you can access and whether you meet their requirements.

Home Equity

You can borrow up to 80% of your home’s appraised value.

Example: If your home is worth $500,000, the most you can borrow is $400,000.

Property Appraisal

A professional appraisal determines your home's current market value and how much cash you can access.

Income Verification

Recent pay stubs, W-2s, tax returns, or other documentation proving stable income.

Credit Review

Your credit score and history help determine your program eligibility and interest rate.

Debt-to-Income Ratio

We'll

review your

monthly debts

compared to your

gross income

to ensure comfortable affordability.

Property Type

Primary residences, second homes, and investment properties may all qualify (requirements vary by program).

Cash Out Refinance FAQs

Whether you're curious about the process, eligibility, or specific details, explore our FAQs to find all your answers.

What is a cash-out refinance?

A cash-out refinance replaces your current mortgage with a new one that’s larger.

Your old loan is paid off, and the difference comes to you as cash.

It’s a way to access your home equity without selling your house.

People confuse this with a second mortgage or HELOC, but this is different.

You're restructuring your entire mortgage, not adding a secondary loan.

How does a cash-out refinance work?

We start by reviewing your situation to make sure a cash-out is actually the right move.

If it is, we order an appraisal to confirm your home’s current value.

Then we shop multiple wholesale lenders to find the strongest rate and loan structure for your profile.

Once the loan closes, your old mortgage is paid off and the remaining cash is wired to your account.

Why do people do cash-out refinances?

Here are the reasons when a cash-out refi makes sense:

• Renovations that increase home value

• Consolidating high-interest credit card or personal loan debt

• Paying off student loans at a lower rate

• Funding a business with cheaper capital

• Investing in a second property

• Covering major life expenses (medical, education)

What you shouldn’t do: take cash just because it’s available.

How much money can I take out?

It depends on your LTV (loan-to-value) and the appraisal.

Most conventional cash-out refis max out around 75–80% LTV.

Example:

- Home value: $600,000

- 80% LTV limit: $480,000

- Current mortgage: $350,000

- Closing costs: roughly $6,000–$10,000 (varies)

- Cash-out: about $120,000 after costs

Note: Cash-out loans sometimes have slightly higher rates, so pulling equity at 80% vs 75% can change pricing.

We usually run multiple scenarios so you can see how LTV affects the numbers.

Will my monthly payment definitely go up?

Not always. It depends on a few variables:

• If your current rate is much lower than today’s rates, then your payment will likely increase.

• If you're rolling in debt with high monthly minimums, then your total monthly outflow can actually decrease even if your mortgage payment increases.

• If you extend from a 15-year to a 30-year term, then your payment usually drops, but you pay more interest long-term.

• If your old rate was high and today’s rate is lower, then your monthly payment may stay similar or drop.

Expert rule of thumb:

Don’t just look at the mortgage payment.

Look at your net monthly cash flow after consolidating debt.

Should I even do this if my current mortgage rate is low?

If you need a small amount of cash and you already have a great rate, refinancing the entire mortgage rarely makes sense.

A HELOC or home-equity loan is usually smarter because it keeps your low rate intact.

BUT there are exceptions:

• You’re consolidating a lot of high-interest debt

• You’re renovating a primary home

• You’re purchasing another property

• Your cash-out amount is large enough to justify the rate trade-off

• Your current mortgage balance is small, so the rate difference matters less in real dollars

Expert Tip: compare the total cost, not just the rate.

Do I need great credit to qualify?

You don’t need perfect credit, but cash-out refis are more rate-sensitive.

Here’s how the pros break it down:

• 740+ = best pricing

• 700–739 = good pricing

• 660–699 = you can still get it, but rates will be slightly higher

• Below 660 = possible, but depends heavily on equity, income stability, and the lender

We work with multiple lenders, so even if your score isn’t ideal, there’s usually a viable program.

Can I roll closing costs into the new loan?

Yes, and almost everyone does.

Closing costs typically range from 2–5% of the loan, and most homeowners choose to roll those into the loan amount so they don’t pay upfront.

It does increase your new loan balance slightly, but it keeps your cash-out amount intact.

Will a cash-out refinance hurt my credit score?

Only a little, and temporarily.

Here’s what actually happens:

• The credit inquiry: small dip (usually 3–7 points)

• The old mortgage is replaced: normal effect but temporary

• If you use the cash to pay off debt: your score may increase significantly

Many people actually see a net credit improvement within 30–90 days if they’re consolidating debt.

Can I qualify for a cash-out refinance if I'm self-employed?

Yes, but expect more documentation.

Self-employed borrowers usually need:

• last 2 years of tax returns

• year-to-date P&L

• 2–3 months of business bank statements

• proof that the business is active and profitable

We close a lot of self-employed files (especially in Texas where many borrowers are 1099 or run LLCs).

We match you with lenders who are more flexible with non-W2 income.

Underwriters mainly want to see stable income, not perfect income.

Can I do a cash-out refinance on a rental property or second home?

Yes, but the rules tighten.

Investment property cash-outs usually have:

• lower max LTV (often 70–75%)

• higher credit requirements

• higher rates (because rentals default more often)

• stricter reserve requirements (you may need months of mortgage payments in the bank)

But investors still do cash-outs all the time to fund down payments for additional properties (BRRRR strategy).

Can I qualify if I already have a HELOC?

Yes, but the HELOC has to be paid off during the cash-out refinance.

You can’t keep a HELOC open and do a cash-out at the same time because they both tap equity.

We handle HELOC payoff inside the closing for our clients.

Can you get a tax deduction from a cash-out refinance?

You can usually deduct the interest tied to the portion of your refinance that pays off your original mortgage.

The interest on the cash-out portion, however, is only deductible if you use that money for IRS-approved purposes, mainly home improvements that add value to the property.

Under current tax rules (2018–2025), if you use the cash for personal expenses like credit card debt, medical bills, or general spending, the interest on that portion is not tax-deductible.

What are the basic eligibility requirements for a cash-out refinance?

You need three things to qualify:

Enough equity:

- Most lenders want you to keep at least 20% equity after the refinance.

- In Texas, keeping 20% equity is literally required by law for any home-equity loan.

Stable income

- It doesn’t matter if you’re W2, 1099, or self-employed, they just want consistency.

- They don’t expect perfection, but they need to see that you can repay the new loan comfortably.

Decent credit

- You don’t need an amazing score to qualify, but your credit affects the rate.

- Most conventional cash-outs start around 660+, but there are programs that go lower.

If those three pillars are strong, you’re generally good to go.

Does a cash-out refinance change my mortgage rate?

Yes. You’re getting a brand-new mortgage, so you will have a new rate, new payment schedule, and a new amortization timeline.

Cash-out loans almost always price higher than a standard refinance because they’re considered higher risk.

So your quoted rate may be higher than what you see advertised for “refinances.”

Do I need an appraisal?

Always, yes. Cash-out refinances always require a full appraisal because the loan amount is directly tied to your property’s current market value.

• If the market is cooling, appraisals can come in conservative.

• If the market is hot, comps can support higher values.

• Appraisers won’t “stretch” value just so you can get more cash.

• A low appraisal can reduce how much cash you’re eligible for.

We usually check local comps before ordering the appraisal so you have realistic expectations.

How long does a cash-out refinance take with ACM?

On average, 21–30 days — but here’s what actually controls the timeline:

1. Appraisal speed

This is usually the biggest delay. Some Texas markets have fast turnaround, others take 7–10 days depending on appraiser availability.

2. How quickly you send your documents

Even small delays (like needing an updated bank statement or missing IRS transcript) can add a few days.

3. Underwriting backlog

Wholesale lenders move faster than big retail banks, but month-end can still slow things. We expedite the proces

Realistically, ACM moves quicker than most lenders because they push files through multiple channels, not just one bank’s queue. That’s a big broker advantage.

Will refinancing affect my homestead exemption or property tax benefits in Texas?

No, absolutely not.

A refinance doesn’t change:

• your homestead exemption

• your property tax cap

• your appraisal district status

• your tax history

Texas law treats refinancing as a non-event for property tax purposes. Only transferring ownership affects those things.

Will I lose all my equity?

No. You legally can’t, especially in Texas.

In Texas, the law requires you to maintain at least 20% equity in your home after the cash-out.

Even outside Texas, lenders rarely allow you to go beyond 80% LTV because they want a safety cushion in case home values dip.

So you will always keep some equity; you can’t “drain” the house completely.

Is a cash-out refinance the same as a HELOC?

No, and this is a huge misunderstanding.

A cash-out refinance = one brand new mortgage.

A HELOC is a second credit line on top of your current mortgage.

• Cash-out refi: stable fixed payment, predictable, long-term

• HELOC: variable rate, interest-only, can spike when rates rise

A HELOC is great for short-term use or small amounts.

A cash-out refinance is better for large amounts or long-term planning.

Is a cash-out refi the same as a home-equity loan?

Still no, and this trips people up all the time.

A home-equity loan is a fixed-rate, second mortgage with its own payment.

A cash-out refinance replaces everything with one new loan.

Cash-out refis often have lower rates than home-equity loans because they’re first-lien loans, which are less risky for lenders.

What DTI (debt-to-income) ratio do I need?

Most lenders want your DTI under 45%.

Some allow 50% if your credit score and equity are strong.

If you have high income and low debts, your DTI will be fine.

If you’re carrying heavy credit card balances and car loans, it might be tight, but if the cash-out is going toward paying those off, the math usually works out.

Can I qualify if I have late payments?

Depends how recent they are.

• Mortgage late payments in the last 12 months: usually a deal breaker for cash-out

• Late payments on credit cards or auto loans: lenders can overlook if the rest of the file is strong

But mortgage lates are taken seriously.

Do I need reserves (money in savings) to qualify?

Sometimes, depending on:

• your credit

• your DTI

• whether the property is a primary home or rental

• your overall risk profile

For primary homes, reserves are often not required.

For investment properties, lenders like to see 2–6 months of mortgage payments in the bank.

Is the cash from a cash-out refinance taxable?

No, the cash you receive from a cash-out refinance is not taxable.

The IRS views this money as a loan that you must repay, not as income.

Depending on your situation, there could be tax benefits, especially if the funds are used for home improvements.

Still have a question?

Give us a call or fill out our form, and one of our top mortgage refinance loan officers will assist you with all your questions.

Have questions or feedback? Reach out to our support team at:

Or give us a call at:

2023 Austin Capital Mortgage, a division of Aspire Home Loan | All Rights Reserved | Member FDIC | NMLS 1955132 | Privacy Policy