TEXAS' TOP MORTGAGE LENDERS SINCE '96

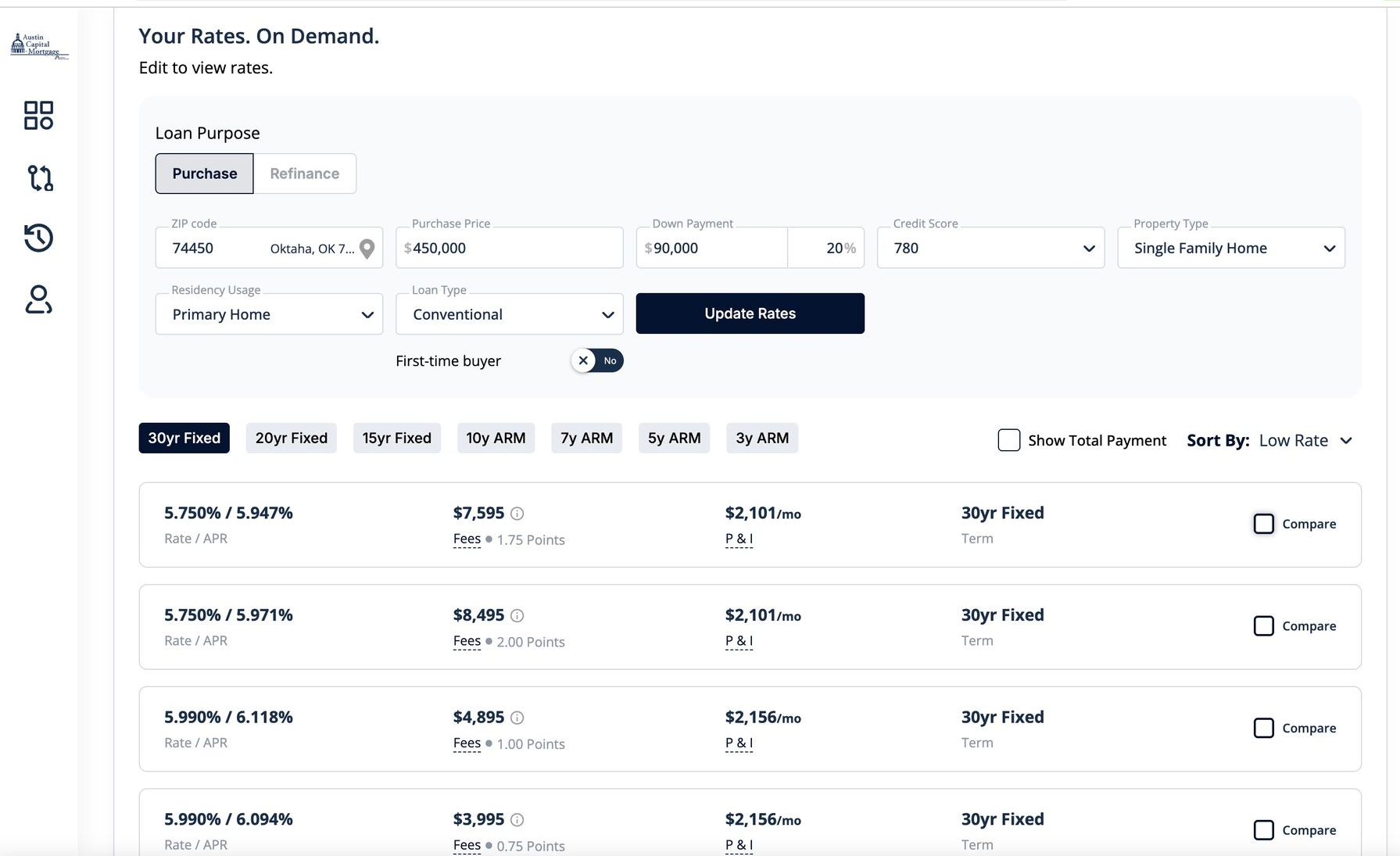

Get Your Rate Comparison Dashboard: Shop 50+ Lenders

View

live mortgage rates

from

multiple lenders, based on your details.

Compare rates, APR, monthly payments, and loan terms.

See Live Pricing From Multiple Lenders

Your personal rate dashboard pulls in live pricing from 50+ lenders; all

in one place.

The dashboard displays

live mortgage rates, not estimates.

Once you submit your information, you'll be able to see:

- interest rates and APR

- monthly principal and interest payments

- lender fees and points

- loan terms and structures

All pricing shown reflects current lender rates at the time you view them.

What Rate Can You Actually Get?

Adjust Your Scenario and See Rates Update

Our rate dashboard lets you edit your details and instantly see updated pricing.

You can adjust:

- loan purpose (purchase or refinance)

- property location and ZIP code

- purchase price and down payment

- credit score range

- property type and occupancy

- loan type

(conventional, fixed, ARM) and more..

When these details change, the rates update to reflect live lender pricing for the new scenario.

Compare Loan Options Side by Side

The dashboard allows you to compare all your mortgage options in one place.

You can:

- view 30-year, 20-year, and 15-year fixed options

- compare ARM loan options

- sort results by lowest rate or lowest payment

- compare multiple loan offers at the same time

This makes it easier to see how rate, fees, and payments trade off across lenders.

Why Mortgage Rates Differ Between Lenders?

Mortgage rates are not universal.

Different lenders price loans differently based on:

- internal guidelines

- risk models

- points and fee structures

- loan term and program availability

That’s why two lenders can quote different rates for the same borrower.

A live rate dashboard makes those differences visible, and helps you make the right decision.

How to Get Your Own Rate Dashboard?

Get your personal rate dashboard in just 2 minutes.

- Submit your mortgage details

- A personalized rate dashboard is generated

- You receive an email with a secure link

You can open your dashboard anytime using that link.

Viewing live rates does

not require a hard credit pull &

does

not obligate you to move forward.

Please, note:

- Rates shown reflect active lender pricing at the time you view them

- Rates are not locked until later in the process

- Final approval happens during underwriting if you choose to proceed

How are we

different

from other

lenders & banks?

We Work for You. Unlike banks, we aren’t tied to a single lender.

We shop all lenders to find you the best mortgage rates.

| Austin Capital Mortgage | Other Lenders |

|---|---|

| Shop 100+ lenders | Pushes their own products only |

| In house underwriting, fewer delays | Slow underwriting process |

| 100% online, secure uploads | Often require office visits |

| Dedicated loan officer, proactive updates | Call centers, long wait times |

Recently Funded Homes

From denied applications to signed contracts, here’s what we’ve funded lately.

Frequently Asked Questions

Or give us a call at: