By Kari Cooper

•

March 10, 2025

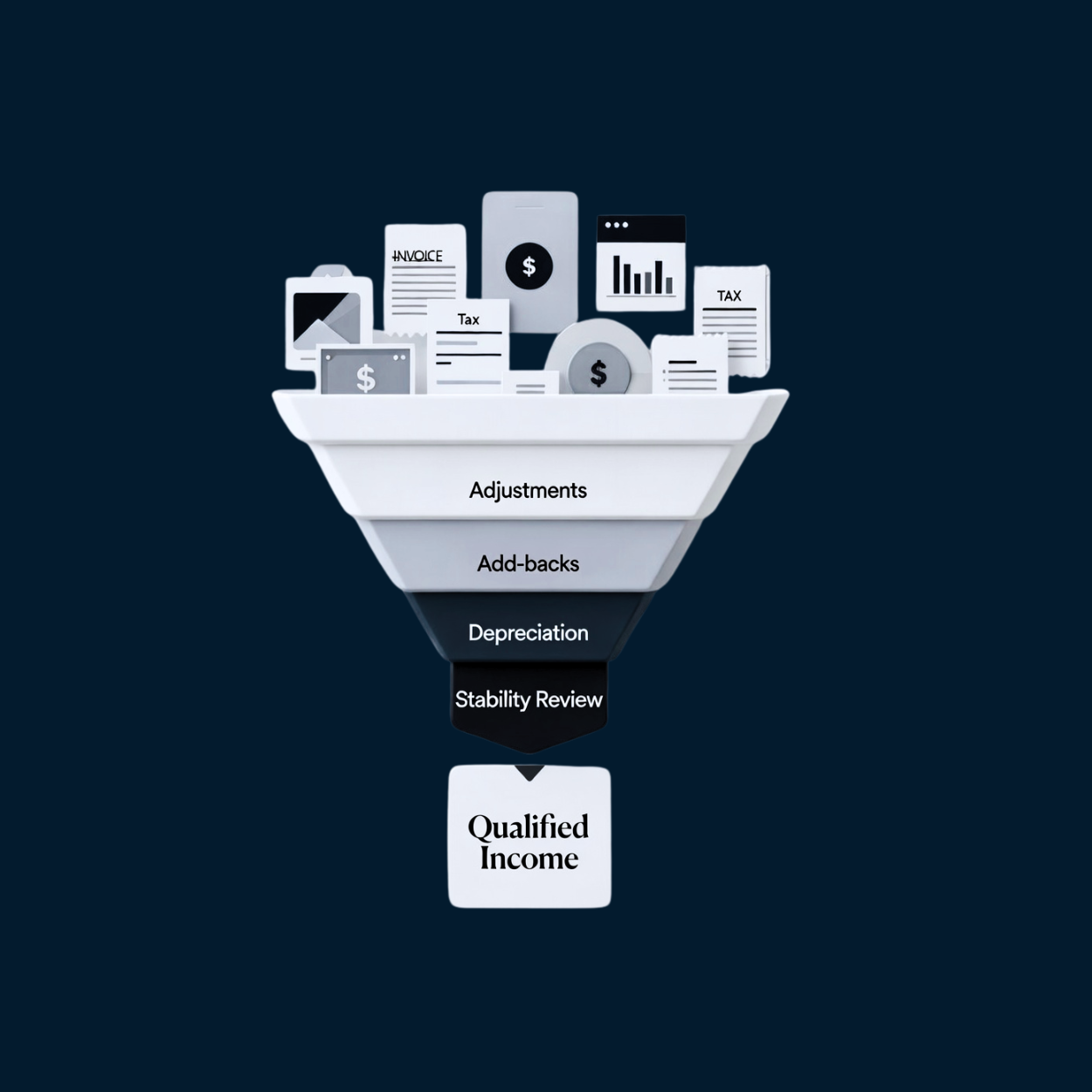

The Texas housing market is buzzing with changes, and if you're a homebuyer, seller, or real estate investor, you’ll want to keep up. Whether you're a mortgage broker helping clients secure the best loan rates or a mortgage lender looking at industry shifts, these trends will impact the market in big ways. Here’s what you need to know for summer 2025: 1. Home Sales Are Picking Up After a bit of a slowdown, Texas home sales are finally on the rise - expected to jump by around 3% this year. If you’re working with buyers, this means more options and a bit less competition than the past few years. Why This Matters for Mortgage Brokers and Lenders A recovering sales market means mortgage brokers can expect more loan applications, and lenders will need to stay competitive with mortgage products that suit different buyer needs. Borrowers may be more cautious about financing, so providing clear, transparent mortgage solutions is key. 2. Home Prices Are Stabilizing Good news for buyers: Prices aren’t skyrocketing anymore. The market is leveling out as supply catches up with demand. Mortgage brokers can leverage this stability to help clients get into homes without overpaying. How This Affects Mortgage Lenders Lenders should prepare for a more balanced market where borrowers may not need to stretch their budgets as much. However, since affordability remains a concern, offering competitive interest rates and flexible financing options will be crucial. 3. Higher Mortgage Rates Are Sticking Around With mortgage rates hovering around 7%, affordability is still a major concern. Mortgage lenders should be ready to guide borrowers through financing options, including adjustable-rate mortgages (ARMs) or refinancing strategies down the line. Strategies for Mortgage Brokers Educate homebuyers on the benefits of different mortgage products. Help clients calculate affordability in a high-rate environment. Stay ahead of potential rate fluctuations to advise borrowers on the best timing for locking in rates. 4. Texas Population Growth Is Fueling Demand People keep moving to Texas, thanks to strong job growth and no state income tax. This continued demand means mortgage brokers and lenders will see steady business, especially in cities like Austin, Dallas, and Houston. Impact on Real Estate Financing Population growth means a steady demand for mortgages, but it also puts pressure on home prices and rental markets. Lenders should anticipate increased applications from out-of-state buyers and first-time homebuyers looking for financing guidance. 5. More Homes on the Market = More Choices Texas housing inventory is up 20% compared to pre-pandemic levels. That means buyers aren’t stuck in crazy bidding wars, and mortgage brokers can work with clients to find financing solutions without the rush. What This Means for Mortgage Professionals More inventory means buyers have leverage, so lenders should be prepared for an increase in conventional and FHA loan applications. First-time buyers, in particular, may need extra guidance navigating loan options. 6. Suburban and Rural Areas Are Hot Right Now City living isn’t for everyone, and more buyers are looking at suburban areas like New Braunfels and Canyon Lake for more space and a lower cost of living. Mortgage lenders should take note of shifting loan demands in these growing areas. Adapting to the Shift Offer specialized mortgage programs for rural and suburban homebuyers. Work with realtors to identify emerging housing markets where loan demand is increasing. Highlight financing options that cater to properties with more land or unique zoning restrictions. 7. The Rental Market Is Strong With high mortgage rates, some buyers are holding off and renting instead. This makes Texas a great spot for real estate investors looking for rental properties. Mortgage brokers should be ready with loan options for investors eyeing the rental market. Opportunities for Mortgage Lenders Market investment property loan programs to real estate investors. Offer refinancing options for landlords looking to optimize their portfolios. Provide guidance on how rental income can impact mortgage qualifications. 8. Smart Homes Are a Big Selling Point Buyers want homes with smart tech - think security systems, energy-efficient appliances, and voice-activated controls. Mortgage lenders may see more loan applications for new builds featuring these upgrades. What This Means for Home Financing Consider promoting loan options for energy-efficient and smart home upgrades. Educate borrowers on how smart home features can impact property value and insurance costs. Work with builders to offer financing for smart home packages. 9. Sustainability Is a Selling Point Green homes with solar panels and energy-saving features are in high demand. If you’re a mortgage broker, educating buyers on financing options like energy-efficient mortgages (EEMs) could be a game-changer. Mortgage Strategies for Sustainable Homes Offer energy-efficient mortgage programs. Educate borrowers on the long-term savings of green homes. Collaborate with builders who specialize in sustainable construction. 10. New Housing Policies Could Shift the Market From tax incentives to zoning changes, government policies can impact affordability and loan availability. Mortgage lenders should stay updated to help clients navigate the changing landscape. How to Stay Ahead Keep clients informed on policy changes affecting mortgage rates and eligibility. Work with housing authorities to understand new homebuyer assistance programs. Offer flexible lending solutions that align with new government incentives. Final Thoughts The Texas housing market is evolving, and mortgage professionals play a key role in helping buyers navigate these changes. Whether you're advising clients on loan options or helping investors seize new opportunities, staying ahead of these trends will keep you competitive in 2025 and beyond. If you’re a mortgage broker or lender in Texas, now’s the time to optimize your strategies and ensure you’re offering the best financing solutions for a changing market. Stay informed, stay flexible, and help your clients make the best financial decisions possible.